How Does Sequence Risk Impact Your Retirement?

It’s finally here. After years of saving, planning, and dreaming, your retirement is just around the corner. Maybe you've already begun withdrawing your retirement savings, or maybe you’re just about to. Either way, we need to talk about the potential impact of sequence risk (also known as sequence of return risk) on your retirement savings.

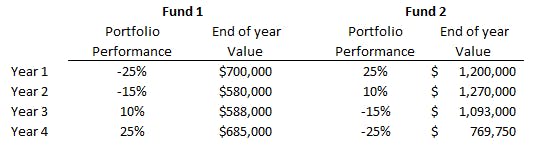

The easiest way to illustrate the sequence of return risk to one’s retirement portfolio is through an example. In the following examples, the Retiree began with a portfolio of $1,000,000 and withdrew $50,000 from the account on December 31st of each year.

In these two examples, we simply reversed the series of annual returns. Before retirement, the sequence of returns will have a negligible impact on one’s portfolio value. Unfortunately, the order of those returns during retirement, coupled with withdrawals, can significantly impact one’s portfolio value over time. As the examples above illustrate, strong portfolio performance in the early years of retirement led to Fund 2 having $85,000 more than Fund 1 after five years.

While we are confident with our assessment of what the capital markets will do over more extended periods of time, the reality is that no one can tell you with any degree of confidence what they will do in any given year. So, how can the sequence of return risks impact you? Once retired, the flexibility on the timing of those withdrawals is probably significantly reduced. You’re probably now wondering – is there anything I can do to mitigate the risk seen in Fund 1? And the answer is, absolutely!

When collaborating with an advisor, they will support you in creating retirement income plans, reviewing your asset mix, asset allocation, and investment holdings within your retirement portfolio to evaluate the risk. During your decumulation phase (AKA converting your retirement savings into regular income), your advisor will look at protecting you against any significant negative returns.

Indeed, withdrawing any investments during a down-market can increase your sequence risk and significantly reduce your remaining capital. Unfortunately, no one can control the markets, so your advisor will plan for conservative returns when building out your retirement income projection. For example, 2% inflation with an investment rate of return of 5%; this approach projects a real rate of return of 2.94%. This way, you build a road map that will continue to provide you an adequate income throughout retirement. Although being conservative doesn’t resolve sequence risk, it captures and accounts for it within your retirement income plan as a worst-case scenario.

The best path to mitigate sequence risk is a well-diversified portfolio that includes assets that are uncorrelated with each other. Today, the conundrum is that most global equity markets move in sync, and fixed income offers minimal return prospects. What's one to do? To build a truly diversified portfolio today, one must look outside of the public equity and fixed income markets and emulate what the big pension funds (like the CPP), Endowments and Foundations have been doing for two decades, and that is to embrace the non-public markets. Assets such as private real estate, private equity, private infrastructure, agriculture, private debt, etc., not only offer diversification benefits just not attainable in the public markets but in many cases offer superior return expectation with lower risk than public equities. If you believe that growth in one's portfolio can only come from public equities, think again!

If bonds and GICs are part of your portfolio, then laddering is also an essential tool in helping mitigate sequence risk. The issue with bonds and GICs today is that they may not provide enough income to meet your spending needs, given historically low low-interest rates.

In addition, as part of a well-designed retirement income plan, you can consider accessing your home equity via a HELOC (Home Equity Line of Credit) to help provide cash flow in a market downturn, rather than selling investments that have possibly dropped. This step can effectively improve your net worth and create stability and longevity within your retirement portfolio.

Regardless, risk cannot be eliminated entirely - including sequence risk. Reaching out to one of our wealth strategists to develop a retirement income plan that fits your needs is a start. Building a well-diversified portfolio, continuous monitoring, and adjusting throughout your retirement are critical components to reduce sequence risk and help you enjoy your retirement years.